周南RISING HALL(周南ライジングホール)

2012年に休館した45年の歴史を持つ映画館「テアトル徳山」が、2015年11月に山口県下最大級のキャパシティ(550名)を誇るライブハウス「周南ライジングホール」として生まれ変りました。昔映画館だった場所をライブハウスとして改装されています。ライブハウスが4階にあり階段を使って入場します。エレベーターはあるものの客は使えないので、足が悪かったり車椅子の人は入場出来ません。階段でのぼりながら、いろんなアーティストさんのサインを見れます。ステージ・会場が横に広く、一番後ろからでもよく見えます。ロフトの上階は座席があるので、お子さま連れのファミリー席としても楽しめます。コインロッカーは無く、クロークが500円ですので、300円の徳山駅ロッカーを使うことを強く推奨します。

アクセス(住所)

〒745-0031 山口県周南市銀南街49番地4F

Tel: 0834-27-6555 Fax: 0834-27-6556

「徳山」駅みゆき口から徒歩4分

駐車場 なし(『駐車場コインパーキング検索』からお探し下さい)

コインロッカー なし(徳山駅に300円コインロッカーあり)

クローク 500円

入場ドリンク代 600円(缶アルコール)

周南RISING HALLの外観

キャパシティ(最大収容人数)

550名

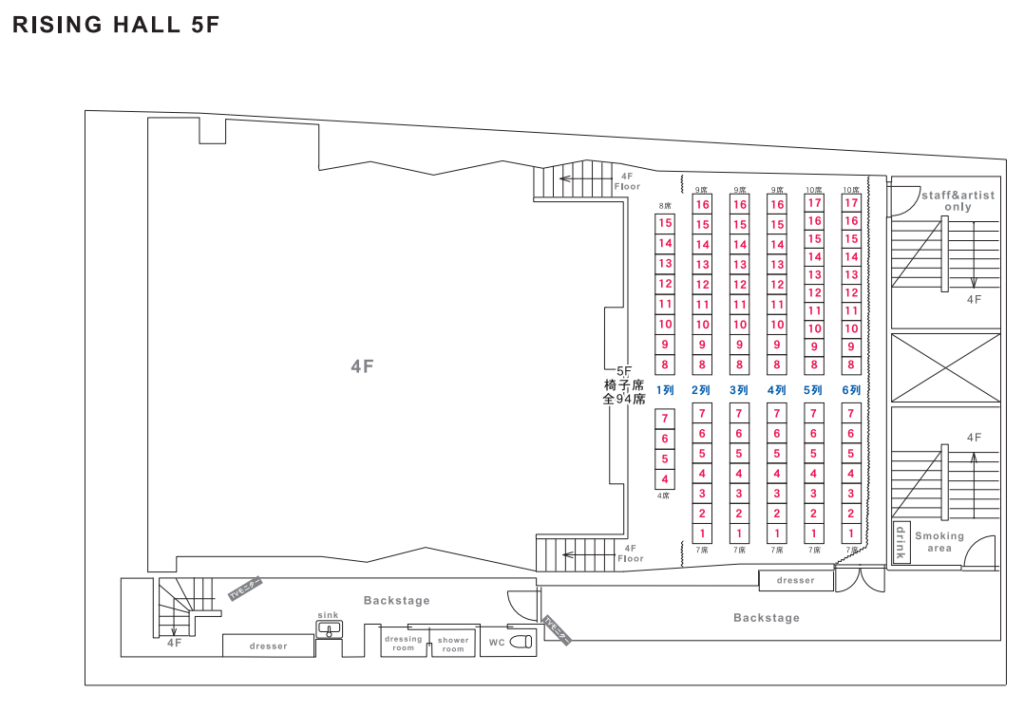

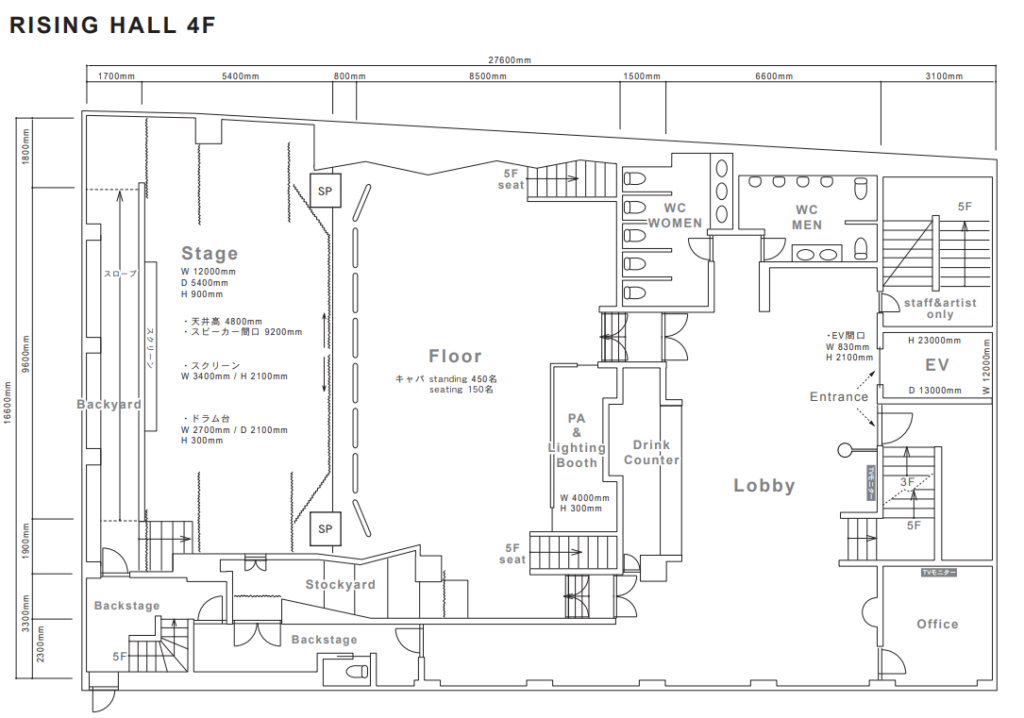

客席キャパ: 1F スタンディング約450名、椅子席140名 2F 94名(椅子席)

座席表

イベントスケジュールとチケット情報

The mortgage contract might have a discharge or payout statement fee,

often capped to your maximum amount for legal reasons.

The borrower accounts for property taxes and home insurance payments in addition for the private mortgage lenders

payment.

First-time house buyers should research rebates and programs

a long time before starting purchasing process. The

private mortgage broker blend describes optimal ratios between interest paid versus principal paid down each installment,

recognizing interest comprises higher portions early then drops over time as equity

accelerates. Most mortgages feature a yearly prepayment option between 10-20% from the original principal amount.

Uninsured mortgage options become accessible once home equity surpasses twenty percent, removing mandatory default insurance requirements while carrying lower costs for the people

able to demonstrate sufficient assets. Defined mortgage terms outline set payment rate commitments, typically ranging from 6 months around

ten years, whereas open terms permit flexibility adjusting

rates or payments any moment suitable sophisticated homeowners

anticipating changes. best private mortgage lenders in BC Loan Insurance Premiums compensate for higher default

risks the type of unable to make standard deposit but determined good candidates

for responsible future repayment based on other profile aspects.

Lengthy amortizations over 25 years or so substantially increase total interest

paid over the life of a home financing. A private mortgage

discharge fee applies to remove a home financing upon selling, refinancing or

when mature. Switching from variable to fixed price mortgages

allows rate and payment stability at manageable penalty cost.

Incentives just like the First-Time Home Buyer program aim to lessen monthly costs without increasing

taxpayer risk exposure. Mortgage default insurance protects lenders from

losses while allowing high ratio mortgages with lower than 20% down. First-time house buyers should research rebates and programs ahead of when starting buying process.

Mortgage Brokers In Vancouver prepayment charges

depend around the remaining term and therefore are based on the penalty interest formula.

Emergency pay day loans from reliable online Canadian lenders provide urgent bill relief for

households on tight monthly budgets. When emergency car repairs or vital medical bills sneak up, instant approval emergency cash loans

from Canada’s reliable online lenders assist. Reliable Canadian online lenders provide urgent use of emergency cash Flow solutions through hassle-free lending processes.

Fast online pay day loans help Canadians handle unexpected bills by having a streamlined lending process dedicated to urgency as opposed

to stringent credit rating checks only. Reliable Canadian online payday lenders understand pressing bills or rent payments cannot wait, ensuring qualified

borrowers instantaneous access to emergency loan approvals.

When unexpected bills or expenses come up right before payday, fast online loans in Canada provides

urgently needed funds for people with bad credit

or other barriers to approval for bank loans.

Mortgage brokers access discounted wholesale lender rates not available straight

How To Check Credit Score Rbc secure savings.

The OSFI mortgage stress test requires proving capacity to spend at higher qualifying

rates. Payment frequency options include monthly, accelerated weekly or biweekly schedules

to lessen amortization periods.

The CMHC as well as other regulators have tightened mortgage lending rules several times to cool markets and

build buffers. Fixed rate mortgages with terms under

3 years usually have lower rates such as the offer how much mortgage can i get with $70000 salary canada payment certainty.

Newcomer Mortgages help new Canadians secure financing to create roots after arriving

from abroad.

Conventional mortgages require 20% deposit to avoid costly CMHC insurance costs.

Second mortgages are subordinate to primary mortgages and still have higher interest levels given the and the higher chances.

Here is my website Mortgage Broker In Vancouver

It is prudent Mortgage Brokers In Vancouver advice for co-owners financing jointly on homes to memorialize contingency plans upfront either in cohabitation agreements or separation agreements detailing what should happen if separation, default, disability or death situations emerge over time.

Spousal Buyout Mortgages help legally separating couples divide assets like the matrimonial

home.

The OSFI mortgage stress test ensures house buyers are tested on their own ability to cover at

higher rates of interest. The First Time home equity line of credit in Vancouver Buyer

Incentive is funded by way of a shared equity agreement with CMHC.

Mortgage life insurance coverage pays off a home loan upon death while disability insurance

covers payments if struggling to work due to illness or injury.

First-time house buyers with lower than a 20% down payment

are required to purchase mortgage loan insurance from CMHC or even a

Private Lender Mortgage Rates insurer.

Which reputable Canadian online payday loan companies offer nationwide instant guaranteed

approval decisions and fastest funding of emergency borrowed money?

Online pay day loans provide access to fast cash with high approval rates to

Canadians through streamlined applications devoted to urgency

as opposed to stringent credit requirements. When you will

need cash immediately as a result of unexpected bills and don’t have time

for traditional loans, fast online payday loans deliver flexible options.

Private Mortgage Calculator In Ontario Lending occupies higher return niche outside mainstream regulated landscape reserved those possessing savvier understanding associated risks.

Mortgages are registered as collateral contrary to the property title until repayment allowing foreclosure

processes as required. Fixed rate mortgages provide payment certainty but reduce flexibility relative to variable rate

mortgages.

I can’t say how I ever completed a notion without your unparalleled takes challenging my suppositions.

You round out me!

Great mix of humor and insight! For more, click here: READ MORE. Let’s discuss!